november 2021 child tax credit date

All payment dates february 25 2022 may 27 2022 august 26 2022 november 25 2022 The first part is 3600 which is part of the expanded child tax credit. Child tax credit deadline coming that could give up to 1800 per child to some families on Dec.

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

The opt-out date is on November 1 so if.

. 1 Close to half of all recipients with household incomes under. 12 2021 Published 1036 am. IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

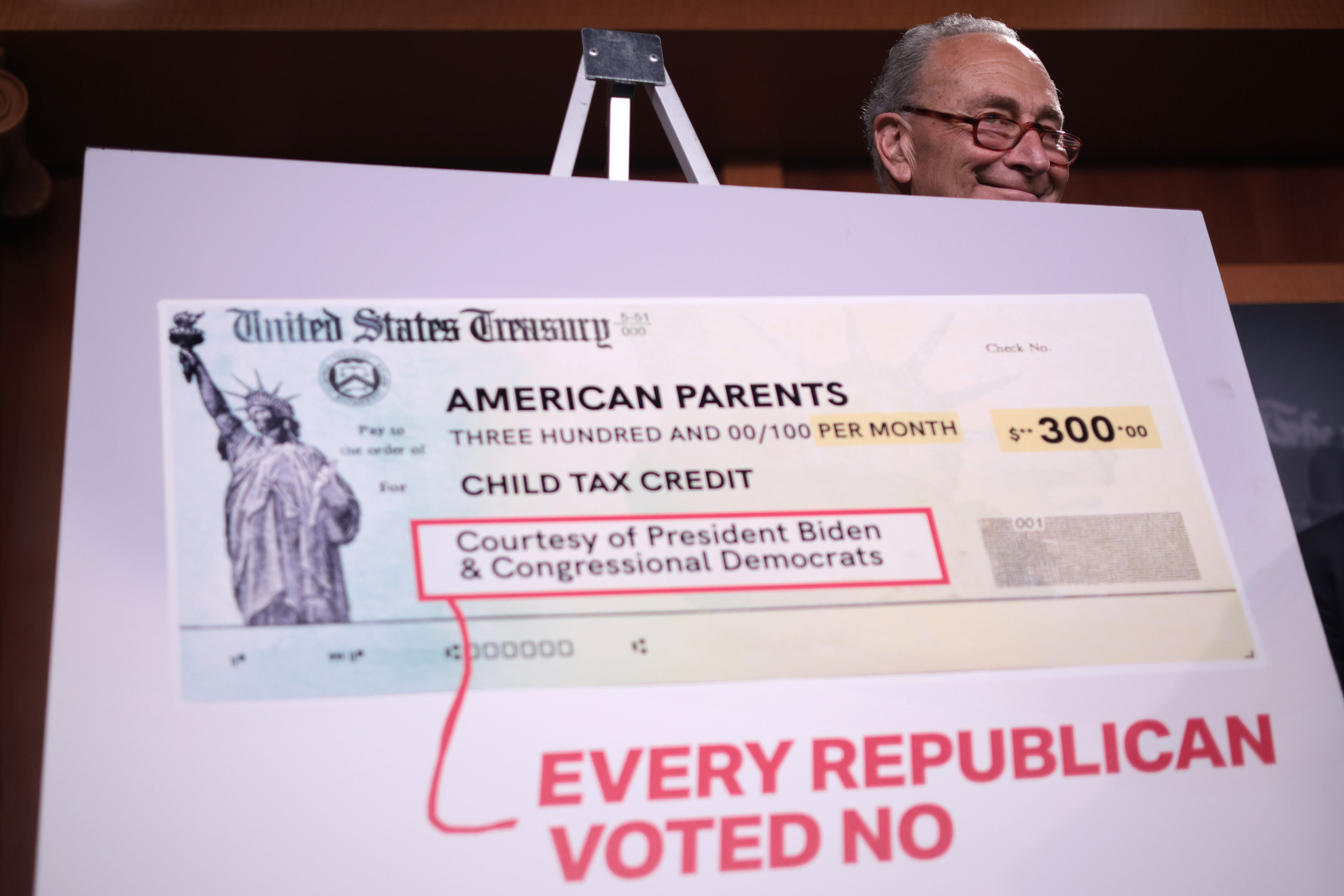

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. In 2021 more than 36 million American families may be eligible to receive a child tax credit. Enter your information on Schedule 8812 Form.

The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

The fully refundable tax credit which is usually up to 2000. Tax Refund Schedule 2022 If You Claim Child Tax Credits. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

But many parents want to. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent.

You will receive either 250 or 300 depending on the age of. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly.

Low-income families who are not getting payments and have not filed a tax return can still get one but they must sign up on. From january to december 2022 taxpayers will continue. The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Will send out Canada Child Benefit payments for 2021 on the following dates. 31 2021 so a 5-year.

Schedule of 2021 Monthly Child Tax Credit Payments. The IRS sent the fifth round of child tax credit payments to approximately 36 million families on November 15. Publication 5534-A 6-2021 Catalog Number 38433P.

15 is also the date the next monthly child tax credit. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021. The IRS bases your childs eligibility on their age on Dec.

It is key to the Bidens administrations effort to. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021. Get your advance payments total and number of qualifying children in your online account.

That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year 250 per month not 3600. 12 2021 Published 1036 am. 7152021 125213 PM.

Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of. November 25 2022 Havent received your payment. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

The IRS has confirmed that theyll. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. The 2021 child tax credit.

Eligible taxpayers who dont want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to unenroll from receiving the payments. 658 PM EDT November 5 2021. November 12 2021 1126 AM CBS DFW.

Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. It is key to the Bidens administrations effort to. The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when filing 2021 taxes.

Child tax credit payment for Nov. The 2021 advance monthly child tax credit payments started automatically in July. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Here are the child tax benefit pay dates for 2022. As a result of the american rescue act the child tax credit was expanded to. Department of the Treasury.

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Dates As Irs Set To Send Out New Payments

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Did Your Advance Child Tax Credit Payment End Or Change Tas

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Pin On Taxation And Business Software

Updates On 38th Gst Council Meeting Gstr 9 Financial Information Council Meeting

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Prince Harry To Return To New York To Present Valor Awards To Veterans Prince Harry Harry Prince

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Tax

Child Tax Credit Will There Be Another Check In April 2022 Marca

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

The Oklahoma State Building And Construction Trades Council Is Hosting Its Fifth Annual Apprenticeship Open House On N Apprenticeship Building Trade Open House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back